Global Integrated Energy Group

We manage energy investments across the entire value chain—from exploration to distribution.

Annual Report

Our Growth and Impact

Our dedication to excellence has enabled us to achieve remarkable milestones, from expanding our portfolio to delivering exceptional results.

Our Passion for Progress

We create innovative solutions to address the challenges of today and tomorrow, guided by our core values to make a lasting, positive impact.

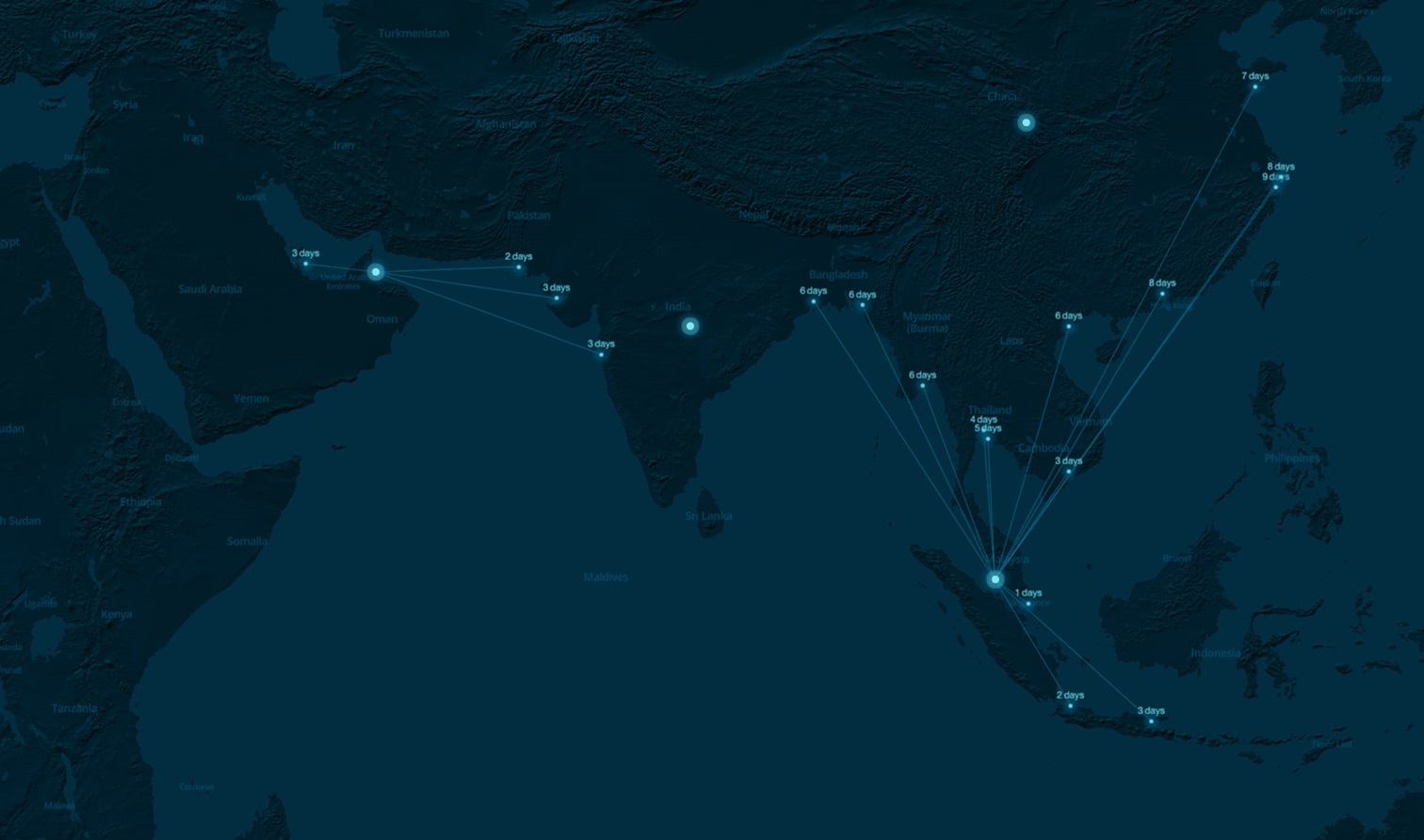

We are an Energy Transition Enabler Based in Oman

Our strategy

Our Investments are Secure and Sustainable

growth projects

Sustainably Efficient in Exploration and Production

Upstream

OQ's downstream business represents an essential link in our integrated value chain

Downstream

We are the National Champion for Renewable Energy

Alternative energy

We strive to contribute towards the national Net-Zero goal by 2050

Sustainability at OQ

Our HSSE Frameworks Create a Safer Workspace

Health and safety

Commitment to Community Empowerment

Social investment

We Invest in the Growth of our People

Careers

Press release

Corporate

Oman Launches a New Era of Clean Energy with the Arrival of Its Largest Wind Turbines Peaking at 200 Meters Muscat – Sultanate of Oman

November 25, 2025

Press release

Corporate

Downstream

Upstream

OQ Strengthens Its Role in Advancing Oman’s Gas Sector Transformation with Five Strategic Agreements and a Memorandum of Cooperation

November 02, 2025

Press release

Corporate

OQ Enables Duqm's Growth Journey through $10+Billion Strategic Investment Shaping the Future of Industry and Energy in Oman

October 24, 2025

Press release

Corporate

OTTCO and ROYAL VOPAK sign strategic agreement to establish a joint venture in the Special Economic Zone at DUQM

October 23, 2025